LTC Price Prediction: Technical Strength Meets Market Consolidation

#LTC

- MACD bullish divergence supports potential upward price movement

- Trading within Bollinger Bands suggests balanced market conditions with $121 resistance target

- Limited direct news catalysts may keep LTC range-bound in near term

LTC Price Prediction

LTC Technical Analysis

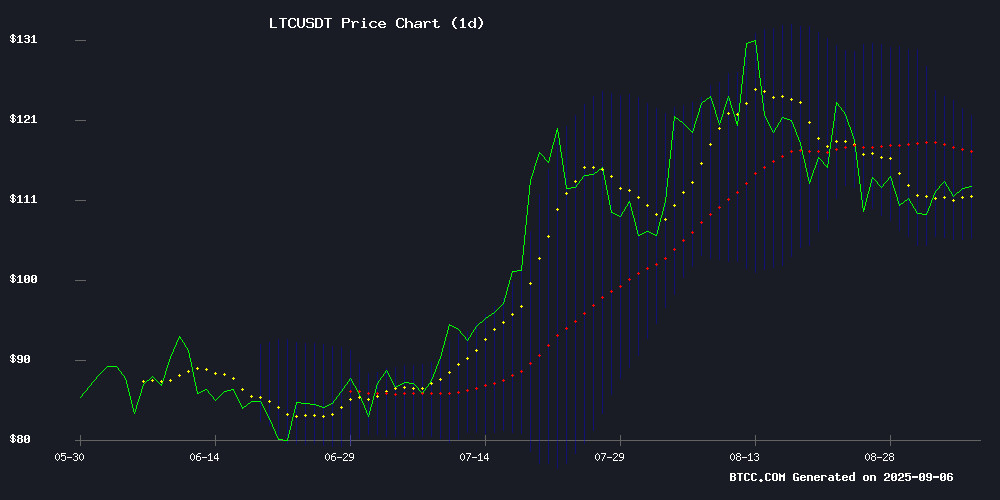

According to BTCC financial analyst Robert, Litecoin's current price of $111.60 sits slightly below its 20-day moving average of $113.51, indicating potential short-term consolidation. The MACD reading of 5.8964 above the signal line at 5.0088 suggests bullish momentum remains intact, though the positive histogram of 0.8876 shows some weakening. LTC trading within Bollinger Bands ($105.74-$121.27) with the price NEAR the middle band suggests a balanced market sentiment with room for upward movement toward the upper band resistance.

Market Sentiment Analysis

BTCC financial analyst Robert notes that while Litecoin faces competition from emerging projects like Remittix and FY Energy, the broader crypto market developments could provide indirect support. The expansion of Trump-backed Thumzup into Dogecoin mining and growing cloud mining traction may create positive spillover effects for established cryptocurrencies like LTC. However, the lack of direct positive news specific to Litecoin suggests it may continue to trade in line with technical patterns rather than catalyst-driven moves.

Factors Influencing LTC's Price

Meme Coin Layer Brett Gains Analyst Attention as Litecoin and Cardano Stagnate

The cryptocurrency market's lethargic giants are being upstaged by an unlikely contender. Litecoin (LTC) and Cardano (ADA) - two established altcoins - show minimal price movement this week, while Layer Brett (BRETT), a new Ethereum Layer 2 memecoin, emerges from presale with speculative 100x potential at $0.0053 per token.

Unlike traditional meme coins dismissed as mere hype, Layer Brett combines viral appeal with technical substance. Its architecture processes 10,000 TPS with $0.0001 gas fees - outperforming Cardano's current capabilities and addressing Ethereum Layer 1's chronic congestion issues. The project mirrors Optimism and Arbitrum's Layer 2 efficiencies but wraps them in meme culture's marketing power.

Remittix Emerges as Top Crypto Pick for 2025, Outshining Bitcoin and Ethereum

The cryptocurrency market continues to evolve in 2025, with Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) maintaining their dominance. Yet, a new contender, Remittix (RTX), is gaining traction as the best crypto to buy now, thanks to its utility-focused innovation.

While established altcoins like Litecoin (LTC), Chainlink (LINK), and Algorand (ALGO) show mixed momentum, Remittix has raised over $23.7 million in its presale, selling 644 million tokens at $0.1030. Unlike speculative assets, RTX targets real-world payment solutions in the $19 trillion remittance market.

Litecoin trades at $113.03 (+1.21%), Chainlink at $23.78 (+1.19%), and Algorand dips 0.44% to $0.2345. Declining volumes suggest investors are seeking fresh opportunities beyond the usual suspects.

FY Energy Emerges as Preferred Platform for Crypto Investors Amid Market Volatility

Bitcoin surged past $111,000 while Ethereum held steady at $4,379, showcasing the cryptocurrency market's characteristic volatility. Dogecoin, often considered the wildcard of digital assets, demonstrated resilience with a 2.2% gain, trading between $0.207 and $0.217.

Amid these fluctuations, FY Energy is attracting BTC, ETH, and DOGE investors with its cloud mining platform promising daily profits up to $6,200. The service offers diversified mining across multiple coins including BTC, ETH, LTC, and DOGE, providing a hedge against market dips through its 100+ eco-friendly data centers.

Ripple's XRP Nears Critical Breakout as Cloud Mining Gains Traction

Ripple's XRP has formed a symmetrical triangle pattern, with analysts eyeing a potential breakout above $3.30 that could propel prices toward $3.70. The cryptocurrency currently trades in a tight range below $3.00, with failure to breach resistance risking a retreat to $2.70.

Amidst the volatility, investors are diversifying strategies—some speculating on XRP's technical patterns while others turn to cloud mining platforms like OurCryptoMiner. The UK-based service reports users generating up to $7,500 daily through automated BTC, LTC, and DOGE mining operations.

Market observers note symmetrical triangles typically precede decisive moves. For XRP, the $3.30 level now serves as a litmus test for bullish conviction, with whale activity likely determining whether the token resumes its uptrend or faces extended consolidation.

Trump-Backed Thumzup Expands Into Dogecoin Mining With Dogehash Acquisition

Thumzup Media, a Nasdaq-listed company endorsed by Donald Trump Jr., is aggressively entering the Dogecoin mining sector. The firm plans to deploy 3,500 mining rigs by year-end through its pending acquisition of Dogehash, a Scrypt-algorithm miner specializing in Dogecoin and Litecoin.

The deal includes Dogehash's existing 2,500-rig fleet and an additional 1,000 rigs to be installed before December, pending shareholder approval. Scrypt's memory-intensive design provides inherent security advantages against large-scale hardware attacks.

Thumzup projects $22.7 million in annual revenue at current Dogecoin prices, with potential upside exceeding $100 million if DOGE reaches $1. The meme coin traded flat near $0.22 on Friday.

This strategic pivot follows Thumzup's January treasury allocation of $1 million in Bitcoin. The company has since expanded its crypto holdings to include Litecoin, Solana, XRP, Ether, and USDC under recently approved board mandates.

FY Energy's FinCEN-Certified Cloud Mining Platform Yields $75,000 in 24 Days Amid 2025 Crypto Volatility

The cryptocurrency market in 2025 remains a high-stakes arena, with Bitcoin holding above $100,000 and Ethereum driving DeFi innovation. Yet volatility continues to erode trader profits, pushing investors toward stable yield opportunities like cloud mining.

FY Energy has emerged as a market leader, combining FinCEN-certified compliance with renewable energy-powered operations. Their platform claims to generate $75,000 returns within 24 days through multi-coin mining of BTC, ETH, and LTC - a proposition attracting yield-seekers in turbulent markets.

Key differentiators include fully solar/wind/hydro-powered infrastructure and transparent regulatory compliance. This eco-conscious approach reduces operational costs while providing institutional-grade security - rare in cloud mining offerings.

Is LTC a good investment?

Based on current technical indicators and market conditions, LTC presents a mixed but cautiously optimistic investment case. The MACD remains bullish and price action near the middle Bollinger Band suggests potential for movement toward the $121 upper resistance. However, investors should monitor key levels closely.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $111.60 | Below 20-day MA |

| 20-day Moving Average | $113.51 | Minor resistance |

| MACD | 5.8964 | Bullish momentum |

| Bollinger Upper | $121.27 | Key resistance |

| Bollinger Lower | $105.74 | Support level |

Robert suggests that while LTC may not be the most exciting short-term play, its technical foundation remains solid for medium-term appreciation potential.